The Swell Blog

Corporate Owned Life Insurance: Everything You Must Know

Life insurance sounds boring and straightforward, right? Not so fast! When you have corporate-owned life insurance, it gets a lot more interesting. Why? Because it directly involves reducing and eliminating tax. Now that I have peaked your interest, let’s do a deeper dive into the ins and outs of corporate-owned life insurance. Read More.

Immediate Financing Arrangement | Key Things to Know

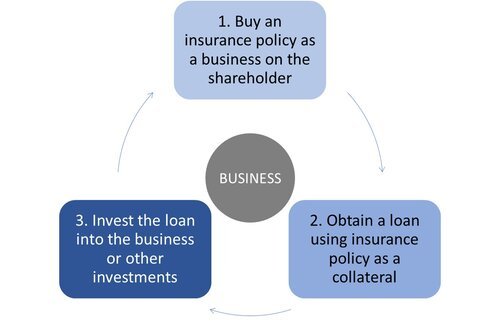

IFA allows a business to finance a life insurance premium on behalf of a shareholder, create tax deductions and ultimately transfer assets tax-free from the business to the shareholder’s estate. It uses a life insurance policy with a cash accumulation component. Read for more.